4 weeks ago

After much debate and soul searching I made a huge decision last Wednesday and decided to withdraw the remaining funds and close my trading account.

It brings to a close around six years of work from when I started this blog in August 2009. It got to the point where I wasn't getting anything back for the work that I was putting in. Short of locking myself in a room and withdrawing from the world I feel it's time for a change.

I've decided to teach myself to code/program, I think the end goal is to combine both trading and coding and perhaps work on some auto trading. I haven't fully decided yet. Who knows, maybe Kinsale Forex Trading will turn into Kinsale Forex Coding!

I still love trading and the amazing community that comes with it. I've met some brilliant traders and people that i'm happy to call friends. I don't think this spells the end but that's it for now.

Thank you to everyone who has read, commented and helped me on my way over this six year period. Through the ups, downs, incessant and quiet times.

I wish you all successful and profitable trading.

That's all for now,

Cheers,

Liam / KinsaleForex

I took one trade on Thursday and three trades on Friday. Thursday's trade was a win. Friday was two losses and a win. After seven trades this week I finished -0.85%. Not as bad as the week before but still not good enough.

Thursday;

Friday in order;

First attempt at selling. Got in a bit early.

Once price bounced from where I was stopped it came back down and produced another sell signal which too me to the target.

Tried to sell again but was stopped out. Price fell again to a low of 1.1324 but there was no signal to get in this time.

I've plans to do some study next week.

I want to print out and look at every trade i've taken this year with this strategy and analyse the pros and cons to see if I can find a common thread through them all. The rights and the wrongs.

As well as this i'm planning on looking at a slightly higher time frame. A 5x3 15min P&F chart comes to mind. As can be seen from Friday's charts, I was ultimately right but my stops are too tight. I want to see if a higher time frame affords wider stops whilst still being able to hit targets.

Enjoy the weekend,

Cheers,

Liam

Thursday;

|

| EU Buy |

Friday in order;

|

| EU Sell 1 |

First attempt at selling. Got in a bit early.

|

| EU Sell 2 |

Once price bounced from where I was stopped it came back down and produced another sell signal which too me to the target.

|

| EU Sell 3 |

I've plans to do some study next week.

I want to print out and look at every trade i've taken this year with this strategy and analyse the pros and cons to see if I can find a common thread through them all. The rights and the wrongs.

As well as this i'm planning on looking at a slightly higher time frame. A 5x3 15min P&F chart comes to mind. As can be seen from Friday's charts, I was ultimately right but my stops are too tight. I want to see if a higher time frame affords wider stops whilst still being able to hit targets.

Enjoy the weekend,

Cheers,

Liam

I didn't take any trades on Monday as I was travelling back from the UK and had work at 4pm.

I took two trades on Tuesday, a win and a loss and a further trade today (Wednesday) which was also a loss.

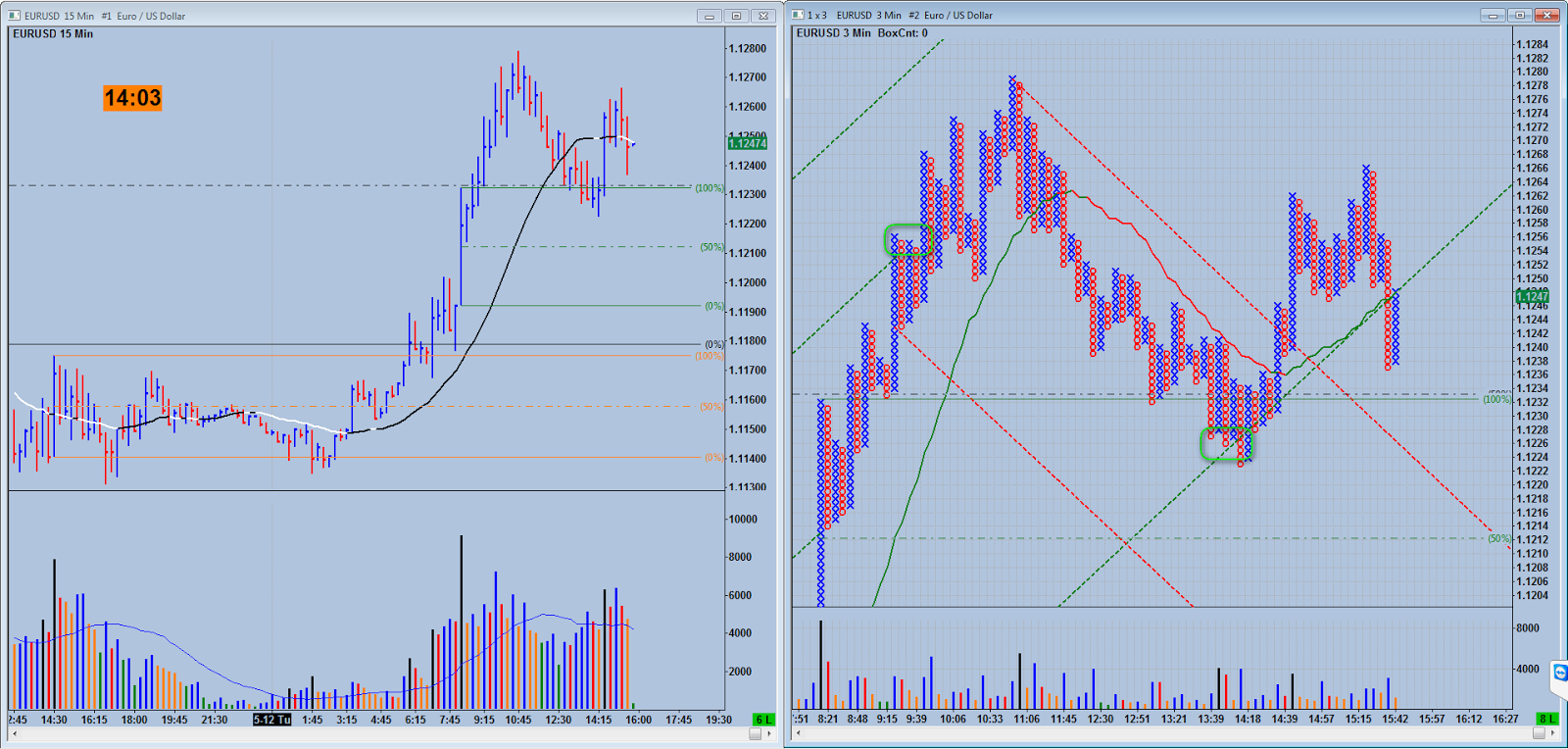

Tuesday.

The winning trade was a buy, shown on the left of the P&F chart. It was a continuation of the up move after the high volume that printed on the 15min chart. Price fell back to the high of this zone, broke through the high and then printed a sell signal at a break of the up channel. I took this sell and it didn't last very long at all. Worth noting that it was the upper half of a zone which has already proved strong. So perhaps needed to wait for it to at least break the 50% of this area.

Wednesday.

Bar 2 is a high volume upthrust into the high of yesterday's volume zone. Also the highest volume for the day (at the time). I took this as weak and took the next sell signal. Below the MA and in line with the trend. But again it wasn't to be. I'm presuming as it's a similar area to yesterday's attempted short that bar 1 is in fact still very strong. This was later proved with a widespread high volume up move on US news at 13:30.

I also wanted to add that NU finally reached the target that I first mentioned in this post. Unfortunately I made very little from this.

I took two trades on Tuesday, a win and a loss and a further trade today (Wednesday) which was also a loss.

Tuesday.

|

| EU Trades |

Wednesday.

|

| EU Sell |

I also wanted to add that NU finally reached the target that I first mentioned in this post. Unfortunately I made very little from this.

|

| NU Target |

5 trades, so I'll get right to it. 2 short term trades on Thursday - a loss and a win. 2 short term trades today - 2 losses. Then there's the long term Kiwi trade which closed today for a small profit of 20 pips after NFP. All in all, the end of a week i'd rather forget about. Kept it simple the last couple of days and completely missed the mark on three of the trades.

Thursday trades

Thursday trades

|

| EURUSD Buy |

The high volume in the red circles on the 15min chart sent this chart down. It just so happened that there was a buy at the high. I made the mistake of thinking that the high volume wasn't weak and went with the trend and MA. I was wrong.

The one successful trade. After it fell from the high I took the next signal that came along after an upthrust into the high of the green zone.

Friday trades

Tried a buy today once price had broken into the orange zone and bounced off the low with a P&F pole. Didn't last very long before pushing back down.

The buy failed so once the stars aligned for a short signal, I took that. This also failed. Stopped with the noise just before NFP. Perhaps I should've closed before this news but I was never in a good position to take some money off the table.

Kiwi Short

It found support where I mentioned in a previous post that it might. I pulled the stop down before NFP announcement which was hit soon after. Bagged about 20 pips but it wasn't worth much as my original stop was 90pips.

-4.82% for the week. Ouch.

I'm now down for the year.

Really need to turn this around and i'm not sure how to approach it.

I'm over the in the UK this weekend for my Dad's birthday. So we'll have some beers, have a chat and try figure out the next approach.

Have a good weekend everyone!

Cheers,

Liam

|

| EURUSD Sell |

The one successful trade. After it fell from the high I took the next signal that came along after an upthrust into the high of the green zone.

Friday trades

|

| EURUSD Buy |

Tried a buy today once price had broken into the orange zone and bounced off the low with a P&F pole. Didn't last very long before pushing back down.

|

| EURUSD Sell |

The buy failed so once the stars aligned for a short signal, I took that. This also failed. Stopped with the noise just before NFP. Perhaps I should've closed before this news but I was never in a good position to take some money off the table.

Kiwi Short

|

| Kiwi 1HR Short |

-4.82% for the week. Ouch.

I'm now down for the year.

Really need to turn this around and i'm not sure how to approach it.

I'm over the in the UK this weekend for my Dad's birthday. So we'll have some beers, have a chat and try figure out the next approach.

Have a good weekend everyone!

Cheers,

Liam